To settle an invoice on the POS

To create and settle an invoice in BackOffice

Invoice management for groups

The Paymaster is the contact (in most cases a company) that is responsible for some, or all, of the group's reservation charges. In Hotels, the contact on the Group Reservation Card is the group’s paymaster. You can route charges to the group paymaster’s account via Routing Rule or via the Hotel Invoice Management page.

Deposits

There are several different methods to make a deposit in Hotels:

- Via the POS

- On the #POS Panel, you can make deposits by pressing the Deposit button. You are then prompted for the amount to deposit. After entering the amount, select the payment method (Card or Cash) in the POS to post the deposit. It will be posted to the finance next time a a statement is posted.

-

Via the BackOffice

- If a deposit process takes place in BackOffice, the URL for a virtual POS needs to be set up in the Hotel Setup page. There you also need to select the POS terminal linked to the transactions of the virtual POS.

Night Audit process

In a hotel’s business environment guests check in and out at all hours and pay their bills either through cash or cards. At the end of the business day, hotels need to record the guests' transactions.

The purpose of the Night Audit is to generate financial transactions for all accommodation that has occurred since Night Audit was last processed.

The Night Audit is normally scheduled at 2:00 AM, but can also be run manually using the Hotel Manual Job action.

The Night Audit includes the following steps:

- Ensures rollover from one business day to the next for every property in the Hotel system.

- Posts transactions to the finance according to a setting in Hotel Setup, see Accrual Accounting.

- Posts accommodation tax to the correct G/L Account, if it is not the same as the sales account.

- Logs error messages if the Night Audit did not finish correctly.

There are two options for the Night Audit, and both are controlled by the Accrual Accounting option in the Hotel Setup.

-

Accrual Accounting = Yes :

Accrual accounting is a financial accounting method that allows a company to record revenue before receiving payment for goods or services sold and to record expenses as they are incurred.

In other words, the revenue earned and expenses incurred are entered into the company's journal, regardless of when money exchanges hands. Accrual accounting is usually compared to cash basis of accounting, which records revenue when the goods and services are actually paid for.

The Night Audit creates a General Journal and posts to finance for each hotel reservation that is In House or Checked Out and Arrival Date is less or equal to Today, and Departure Date is greater or equal to Today. The General Journal is for all charges that are included in the Rate and there is one invoice per day. If there is a customer on the reservation, it is used as a customer for the General Journal transactions, otherwise the Night Audit Customer form in the Hotel Setup is used. In the case that the guest pays the charges, the Night Audit Customer is also used.

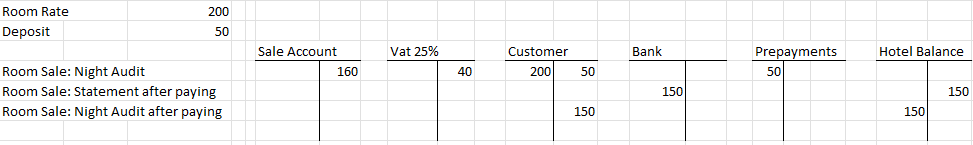

The transactions are posted debit to the Customer account and credit to sales and VAT accounts. At the time of payment the amount is posted debit to the Bank and credit to the Night Audit Temp Balance. The Night Audit finally balances out the Night Audit Temp Balance and the customer account, see example below.

For group reservations, all charges in the sub-reservations are collected into one transaction, if possible, and posted.

If there are prepaid deposits for a reservation the deposit is consumed as much as possible for each day. It is posted debit to the Customer Prepayments account and credit to the Customer account. If the deposit is attached to a Folio then it is only consumed to that Folio but otherwise it is used without a Folio check. The deposit consumption is posted to the Reservation Payment Entry table.

Posting example:

-

Accrual Accounting = No Cash Basis Accounting:

Businesses that use cash basis accounting recognize income and expenses only when money changes hands. They do not count sent invoices as income, or bills as expenses – until they have been settled.

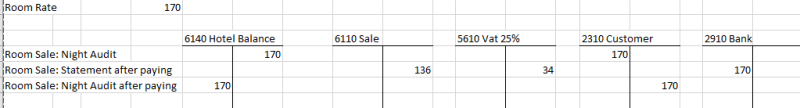

The batch name of the General Journal is NIGHTAUDIT, and it must be posted to finance after the Night Audit Job has finished. It posts accommodation transactions debit to a Night Audit Customer account and credit to a Night Audit Temp Balance account. The Night Audit Temp Balance is the total sum for the Guest Ledger, and is sometimes called Hotel Balance account. This will be posted to the bank and to a sales account when customers settle their bill.

No deposit consumption is done here.

Posting example:

To settle an invoice on the POS

- Select a reservation to open the Reservation Panel.

- Press the Manage Invoices button to open the Split Bill Panel. The Split Bill Panel shows all payers that have been selected for the reservation and the corresponding charges.

- Press the Pay button corresponding to the invoice that is due to be paid. This opens the #POS Panel.

- From there, pick any of the payment methods to settle the invoice. Payment methods include: Cash, Card, Post to Account, and Post to Room.

- Once paid, the system marks all selected lines as paid charges and the amount gets subtracted from the guest’s balance.

To create and settle an invoice in BackOffice

You can settle invoices in the BackOffice as well as on the POS:

- Select a reservation to open the Hotel Reservation Card.

- Click the Invoice Management action to open the Hotel Invoice Management Card.

- Click Create Invoice, and select a customer from the Customer list for the new invoice.

- Select Yes to create a new invoice and to open the Sales Invoice Card. Here you can manage and edit existing unpaid charges, add new lines, edit the sales header, and optimize the invoice details.

Note: There can be many invoices for each reservation, if there is more than one customer on the reservation. - When ready, click Posting, then Post, and finally Yes to post the invoice. Once posted, the system marks all posted lines as paid charges.

Discounts

There are three different methods to give customers discounts in Hotels:

- Via the POS:

- On the #POS panel, each cell in the Discount % column is editable, and when you select it you are prompted with the option to specify the Discount % for the selected line.

- Via Invoice Management:

- On the Hotel Invoice Management Card, the Discount % column is editable, and when you select it you are asked if you want to proceed giving the discount.

- Via posting an invoice in the BackOffice:

- On the Hotel Invoice Management Card,you can create a new invoice and post it by clicking the Invoice action at the top of the card. From there you can edit each line before posting it, including its Discount % via the Line Discount % column.

Credit Invoice

If a reservation is settled with an incorrect payment type (or the rates were wrong), there is a way to void the transaction, prepay and get room rates back on the reservation to invoice room rates again the right way:

- Open the POS.

- Select Transactions.

- Select the relevant Transaction, and press Void – Select – Process return.

- Finalize the balance with a payment type.

- Now you see the room rates in Invoice Management on the reservation as they were before you settled the invoice.

- Finalize the room rates on the reservation with the correct balance or payment type.