With retail charge, you can set up various types of charges within your restaurants, such as service charge and delivery charge.

The retail charge can have the following specifications:

- It can be percentage or amount

- The charge amount can be calculated on net or gross amount

- It can be triggered manually or automatically based on store, sales type, menu type or number of guests

- VAT or tax is added to the charge according to the assigned income account

- The charge is printed on the receipt

- The charge amount can be fixed, then it is not necessary to define charge lines

- The retail charge can apply to specific items, product groups, special groups or all items.

- You can exclude items, product groups and special groups from the charge

You set up retail charges in the Retail Charge Card.

-

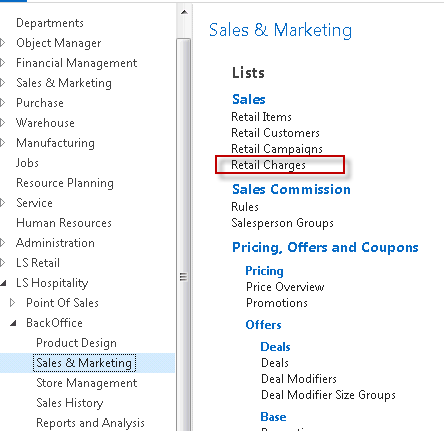

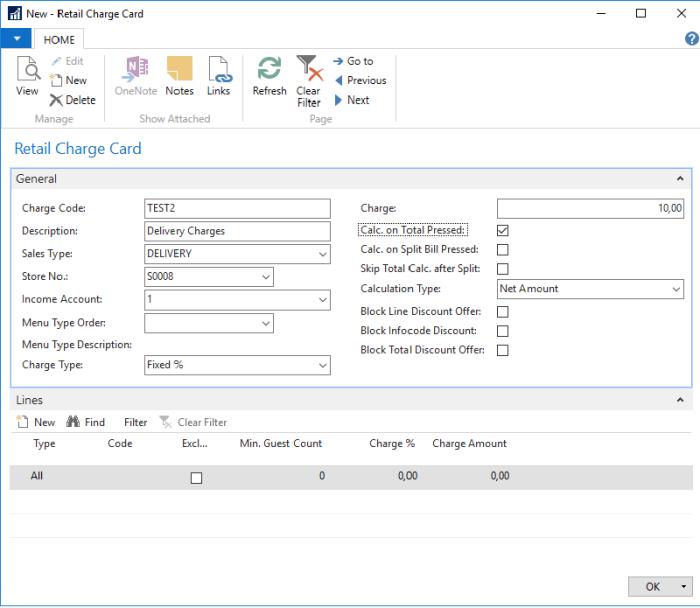

Open the Retail Charges page.

-

Click New to create a new retail charge.

-

Fill in the fields according to the field guidelines.

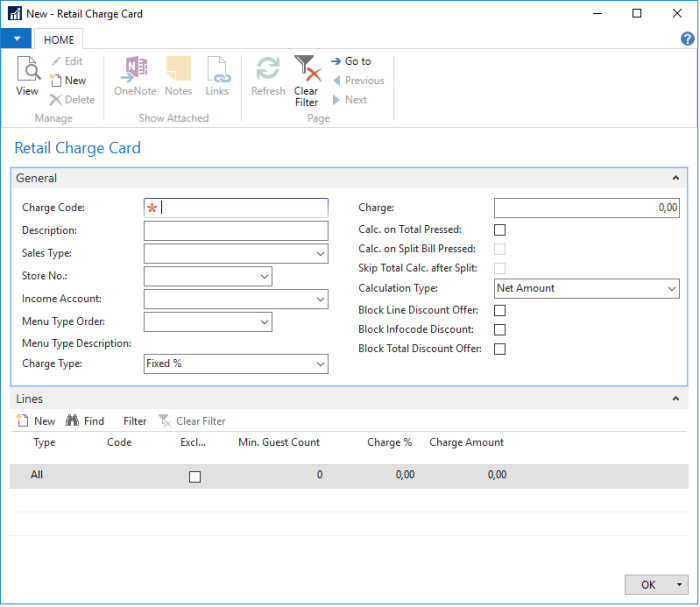

Example 1: Retail Charge that will add 10% charge to Store S0008 and Sales Type DELIVERY when Total is pressed.

Example 2: Retail Charge that will add 10% charge to Product Group MEAT excluding item 32120. This is applied by pressing a Menu Button with command RETAILCHARGE and Parameter EXTRA and thus the Sales Type and Store are not used as filters like in Example 1.

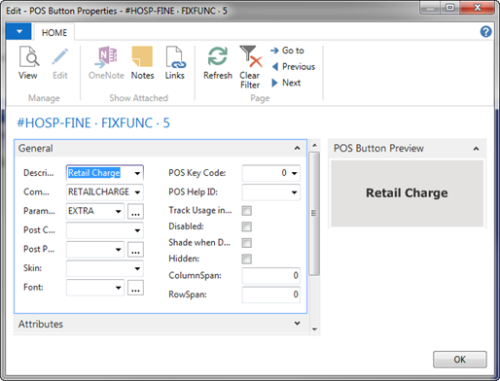

Definition of the Menu Button:

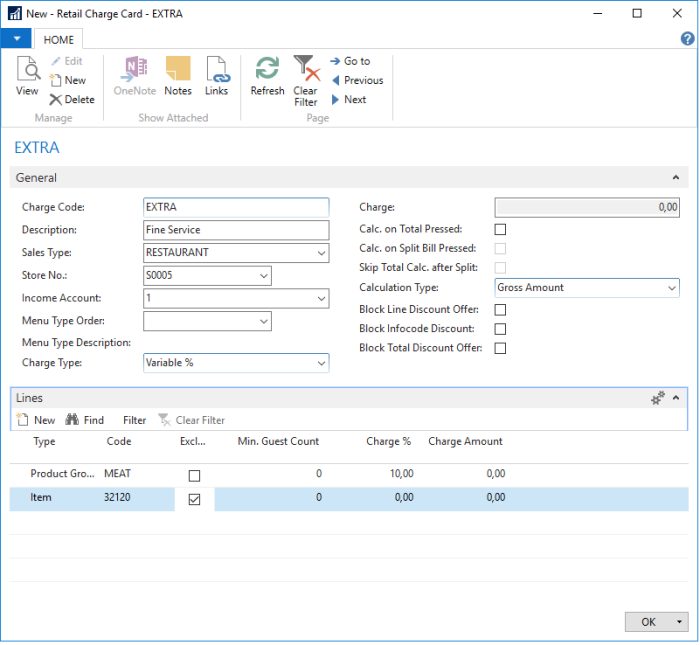

Definition of the Retail Charge:

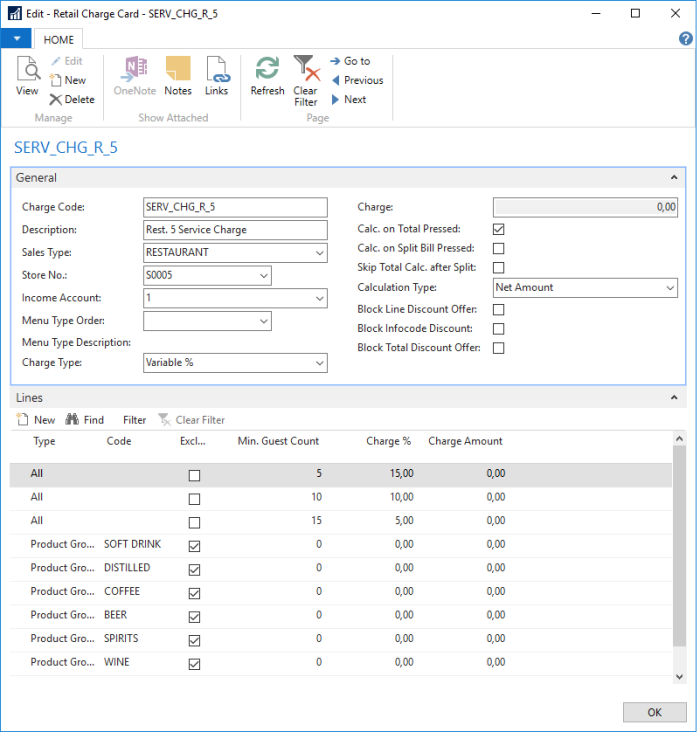

Example 3: Retail charge that adds 15% charge if guest count is 5 to 9, 10% if guest count is 10 to 14, and 5% if guest count is 15 and higher. The charge is on net amount of all item lines except for drinks. The retail charge is assigned to a POS menu button.